income tax relief 2020 malaysia

Based on aggregated sales data for all tax year 2020 TurboTax products. The 2019 income tax filing and payment deadlines for all taxpayers who file and pay their Federal income taxes on April 15 2020 are automatically extended until July 15 2020.

Personal Tax Relief 2021 L Co Accountants

In Malaysia income derived from letting of real properties is taxable under paragraph 4a business income or 4d Rental income of the Income Tax Act 1967.

. Resident individuals are eligible to claim tax rebates and tax reliefs. To do this file Form 1040-X. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

Below are the Individual Personal income tax rates for the Year of Assessment 2021 provided by the The Inland Revenue Board IRB Lembaga Hasil Dalam Negeri LHDN Malaysia. 30042022 15052022 for e-filing 5. RinggitPlus Everything you should claim as Income Tax Relief.

The relief amount you file will be deducted from your income thus reducing your taxable income. Americas 1 tax preparation provider. Form P Income tax return for partnership Deadline.

A tax planner tax calculator that calculate personal income tax in Malaysia. A tax relief limited to RM6000 is available for purchases of special support equipment for yourself your spouse children or parents who are disabled. Make sure you keep all the receipts for the payments.

Theres even a tax relief for alimony payments. Income tax return for individual who only received employment income Deadline. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields.

This relief applies to all individual returns trusts and corporations. Read Personal Income Tax Rebate and Personal Income Tax Relief for details. RinggitPlus Malaysia Personal Income Tax Guide 2020.

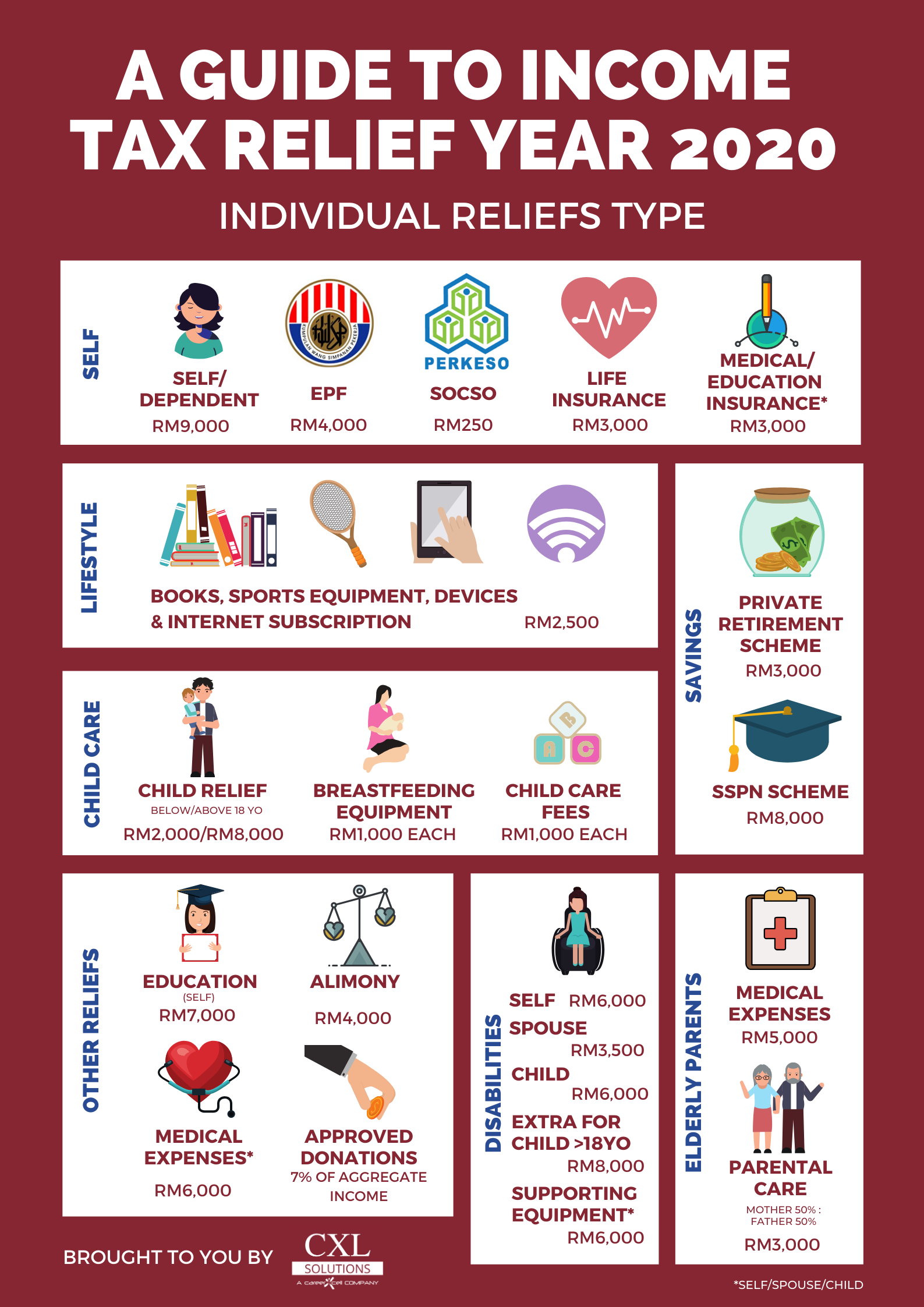

Additional tax relief of RM500 for any expenditures related to purchase of sporting equipment rental of. Tax Relief For Resident Individual for Assessment Year 2020. Tax rebate for self If your chargeable income after tax reliefs and deductions does not exceed RM35000 you will be granted a rebate of RM400 from your tax charged.

Equipment for disabled self spouse child or parent. Below is the list of tax relief items for resident individual for the assessment year 2020. This tax incentive is available until assessment year 2025.

1 best-selling tax software. The total relief amount was raised by RM2000 from YA 2020s RM6000 in this category. 1 online tax filing solution for self-employed.

For the full list of personal tax reliefs in Malaysia as of the. No other taxes are imposed. Tax residents can do so on the ezHASiL portal by logging in or registering for the first time.

The GoBear Complete Guide to LHDN Income Tax Reliefs. The good news is an individual who makes contribution to his or her PRS funds is allowed to claim personal tax relief of up to RM3000 by the Inland Revenue Board of Malaysia. The PRS Tax Relief was specially introduced to encourage you to save more for your retirement.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. The income tax rates 2021 exemption limit for compensation for loss of employment will be increased from RM10000 to RM20000 for each. Foreign tax relief and tax treaties.

CompareHero 7 Tax Exemptions in Malaysia to know about. This relief is automatic taxpayers do not need to file any additional forms or call the IRS to. Resident company other than company described below.

30062022 15072022 for e-filing 6. Budget 2021 is the largest budget in Malaysias history with a total of RM3225 billion compared to RM297 billion for Budget 2020. LoanStreetmy 9 Things to know when Doing 2019 Income Tax E-Filing.

100 deductions can be availed if they donate their money to fund such as Prime Ministers relief fund National Defense Fund National Illness Assistance Fund and so on. Form B Income tax return for individual with business income income other than employment income Deadline. The main objective is to help taxpayers who have lost their jobs due to the current pandemic.

The deadline for filing your income tax returns form in Malaysia varies according to what type of form you are filing. Its tax season again for Malaysians earning over RM34000 for the Year of Assessment YA 2020. The Government of Malaysia is fairly reasonable allowing us to get personal tax reliefs from lifestyle expenses such as gadgets and sports equipment to mandatory ones such as education and medical expenses for our parents and ourselves.

Smartphones and tablets made between 1 June 2020 until 31 December 2021. Income Tax Exemptions - Find list of tax exemptions options for FY 2020. Based upon IRS Sole Proprietor.

To claim the additional exclusion you must amend your 2020 tax return. The income is deemed as a business sources if maintenance services or support services are comprehensively and actively provided in relation to the real property. If youve received your Income Tax Return EA Form you may start filing your taxes now up until the deadline on April 30 2021.

For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2020. Enter the tax relief and you will know your tax amount tax bracket tax rate. Foreign earned income received in 2020 for services you performed in 2021 can be excluded from your 2020 gross income if and to the extent the income would have been excludable if you had received it in 2021.

Find tax saving investments under 80c to 80u of income tax act of India. A tax rebate directly reduced your amount of tax charged and there are currently four types of tax rebates for income tax Malaysia YA 2019. Malaysian personal tax relief 2021.

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Infographic Of 2020 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Individual Income Tax In Malaysia For Expatriates

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Ttcs Tax Reliefs Ya 2020 Thannees

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Finance Malaysia Blogspot Personal Income Tax Relief For Ya2020

Ttcs Insights To Budget 2021 Thannees

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Sspn Tax Relief 2019 Gabrieltrf

Keeping Book Receipts With Amazon Kindle For Tax Relief In Malaysia

Finance Malaysia Blogspot Personal Income Tax For Ya2019 What Life Insurance Category Changed

Lhdn Irb Personal Income Tax Relief 2020

Income Tax Relief Items For 2020 R Malaysianpf

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

No comments for "income tax relief 2020 malaysia"

Post a Comment